Exhaust gas cleaning systems, better known as scrubbers, have been under the spotlight in the shipping industry for a few years now, as owners debated the pros and cons of their installation.

One of the most compelling drivers behind the installation of the technology as a means of cutting sulphur emissions was a quick return on investment as well as premium earnings when compared to ships running on much more expensive compliant fuels.

Most of the installations use sea water as the process fluid and discharge the treated and monitored water overboard, the so-called open-loop scrubbers. Hybrid systems and closed-loop scrubbers have been less popular among the owners being more expensive and more complex to maintain.

Following the latest scrubber ordering boom last year as owners prepared for the IMO 2020, the situation on the market has changed considerably.

Offshore Energy – Green Marine spoke with Fabian Kock, Head of Section Environmental Certification DNV GL – Maritime, to address some of the hot issues surrounding scrubber technology today.

Malfunctions and Reliability

The expected lifetime of scrubbers is set at around 10 years. However, aside from the discharge of wash water, which has been debated considerably among port authorities, with some ports even banning the discharge, scrubber malfunction cases have received much attention.

Based on a recent survey conducted by DNV GL which included around 60 owners with 800 years of experience with scrubbers, it was found that the most prone to failure were either the sensors used to report the correct functioning of the scrubbers towards port state control, control monitoring systems, or corrosion on pipework and discharge outlets.

Commenting on the frequency and severity of such instances, Kock said that one should be careful when looking at media reports and the internet as sometimes the malfunction cases get misreported and overexaggerated.

“We haven’t seen any serious incidents involving scrubbers,” he said.

“If the owners follow the instructions and recommended maintenance intervals, mandatory checks, and class rules, which are as important as manufacturers’ recommendations, there shouldn’t be a major problem.”

Material quality, i.e. alloy thickness, and proper welding have been identified as key factors in reducing corrosion cases to a minimum in addition to training of the onboard crew to operate and maintain scrubbers.

Usually, training is conducted during the installation process while a ship is in drydock and typically involves 2nd engineers and 3rd engineers in a very busy environment.

However, with the latest developments involving COVID-19, companies like Yara Marine have introduced online training for seafarers to boost their confidence and make sure scrubber operation is done properly.

In 2018, DNV GL introduced thickness requirement for scrubbers discharge pipes, which, as Kock explained, seemed more stringent when compared to other class societies’ rules. Shortly after that other class societies followed suit with similar requirements in order to ensure the quality of operation, reaffirming DNV GL’s position on the thickness requirement as a major prerequisite for the proper functioning of scrubbers.

Where are we now?

As of May 2020, the scrubber-fitted fleet stands at 2,893 ships, or 2.9% of the combined fleet in terms of ships, but equal to 15.6% of total fleet when looking at deadweight tonne, based on Clarksons’ data.

The IMO Global Integrated Shipping Information System (GISIS) data shows that until now a total of 2,045 scrubbers have already been installed and fully approved.

According to the data from DNV GL, some 4,047 ships with scrubbers were set to be in operation or on order by the end of 2020.

The number of ships with scrubbers in operation or on order is expected to hit 4, 131 by 2023, based on the data available so far.

Most of the scrubber systems are open-loop, 3, 358, followed by 689 hybrid systems and only 62 closed-loop scrubbers, DNV GL’s data indicates.

Retrofit projects account for more than half of the installations with 2, 985 ships, while newbuilds account for 1, 146 ships.

COVID-19 impact on scrubber uptake

The outbreak of the COVID-19 pandemic has swept across the world impacting all segments of life and inflicting a horrific blow to the global economy.

The black-swan event has seen companies across the board enact cost-cutting measures wherever possible to preserve liquidity as uncertainty on the outlook persists.

Scrubber installation has topped the capital expenditures list for many companies that have opted to delay installations for a later stage.

Scorpio Tankers and Scorpio Bulkers have delayed a total of 31 scrubber installation projects for next year, followed by DHT Holdings which delayed retrofitting on five very large crude carriers, and Wallenius Wilhelmsen which delayed installation on four ships as part of its steps to preserve cash.

The latest one to join the group is Frontline, which pushed installations on five ships leaving them to trade longer in a lucrative tanker market while bunker prices of compliant fuels remain low.

In addition, Stolt-Nielsen said back in April that it was looking for ways to cut expenditures during the pandemic, and that it was planning to cancel scrubber retrofits on its tankers where possible.

Even though dozens of scrubber projects have been delayed by owners, they still remain in plans and have not been canceled completely. How will these developments impact the uptake figures in the long run, it remains to be seen.

Project delays

On the supply side, the lockdowns in China, whose shipyards have been in charge of the majority of scrubber retrofits, have delayed numerous project installations.

However, the country has been ramping up production over the past month as lockdown measures started to be eased at its industrial sites.

Still, numerous challenges persist when it comes to manning, surveying, and commissioning equipment into service.

“From the suppliers’ side in Europe, there is still a challenge for commissioning engineers to travel to China as they have to undergo a 14-day quarantine period, before being allowed to enter a shipyard. As such, many suppliers don’t have the possibility to send their engineers to China,” Kock explained.

As a result, the process is being overseen and commissioned by local staff in China.

When it comes to scrubber installations, surveyors are always present during the installation in the shipyards, and those are predominantly the local staff who are actively involved in the process.

“Before the scrubbers are formally approved and published on the IMO GISIS web page, you need to check the correct functioning of the system which can only be done during a sea trial,” Kock said.

For retrofits, there have been no special sea trials for verification of scrubbers’ operation, because ships had to return to trade immediately. As such, surveyors were often asked to join the ship on its trade to verify their functioning, which was difficult to organize and costs time and money.

DNV GL has devised an innovative scheme which is being implemented since last year to overcome challenges like this.

Namely, the classification society has launched alternative schemes on how to survey scrubber installation by employing advanced technologies, meaning remote surveys.

“We can survey report sheets from sea trials in our offices in Hamburg and Oslo. That is what we have been doing already in August and September 2019,” he pointed out, adding that remote surveys have also enabled DNV GL to continue working during the pandemic relatively uninterrupted.

Has the investment case disappeared?

Scrubber-fitted vessels have been earning premiums for owners since the entrance into force of the IMO 2020 sulphur cap at the beginning of January 2020.

The price of the compliant fuels and their quality were among the main concerns of the shipping majors prior to the regulation’s entrance into force. As such, owners rushed to the yards to book their slot for a scrubber installation instead.

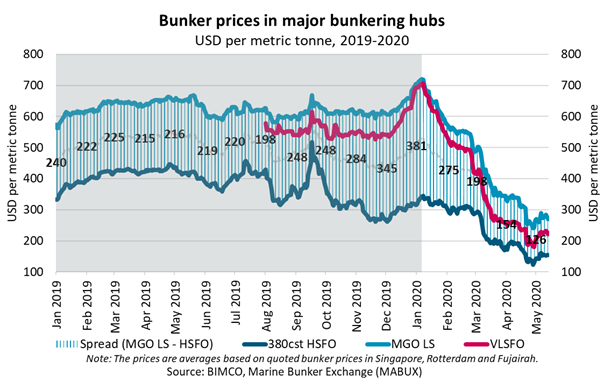

Nevertheless, with the latest oil price collapse and subsequent drop in the price of compliant fuels, the widely touted price differential between High Sulphur Fuel Oil (HSFO) and Very Low Sulphur Fuel Oil (VLSFO) has narrowed considerably.

“Payback time highly depends on the price difference between HSFO and VLSFO. The fuel price spread started at $300 difference per ton in January and now the difference has dropped almost to $50 per ton. However, we are seeing that the fuel prices are going up again now, allowing for the price difference to be somewhere between $50-80 depending on the ports where you purchase the fuel,” Kock said.

“As a rule of thumb, when you have a $200 price difference between HSFO and VLSFO, the payback times are between one and two years. And now we can say that this has changed considerably.”

Commenting on the impact of the COVID-19 on the industry’s decarbonization efforts and the potential impact of the pandemic on their pace, Kock said that short term deadlines might be affected, however, he doesn’t see a major impact of the pandemic on the IMO targets in the long term.

“The developments are ongoing, I am in contact on a daily basis with engine manufacturers who want to test biofuel, ammonia, etc so I don’t see a change here,” he added.

The post DNV GL: We haven’t seen any serious incidents involving scrubbers appeared first on Offshore Energy.